Beware The Enemy Within

Studies show that overconfidence is a wealth hazard and research suggests that we all are more likely to have an inflated opinion of our abilities. Men particularly, seem to suffer most when it comes to overoptimism in their engagement with investment markets. This leads to higher levels of trading activity, increased costs and taxation liabilities and lower investment returns through poor decision-making.

Brad Barber, Professor of Finance at the University of California’s Graduate School of Management and Terrance Odean, Professor at Berkeley have conducted extensive research into investor behaviour and psychology.

One such study analysed the share investments made by 35,000 households using data from a large discount broker over a period of six years during the 1990s. Although this study was conducted in the last decade of last century, their findings remain as relevant today as they were then. They posited that as a general rule human beings tend to be overconfident about their abilities, their level of knowledge and their prospects of future success.

Barber and Odean observed that overconfidence is greatest when people are dealing with more difficult tasks, or making forecasts about factors that are not easily predicted and when the cause and effect is not clear and immediate.

Selecting which shares will outperform the overall market is a difficult task. The chance of success is relatively low and the feedback is noisy because it is not easy to differentiate between luck and skill. So stock picking is a good example of the type of activity in which people are likely to be highly overconfident. That is, people overestimate the chance that their assessment of a company’s value is more accurate than the overall market assessment.

Overconfident investors tend to trade excessively, have unrealistic beliefs about how high their returns will be and also about the level of precision that can be obtained when making forecasts. As a result, not only do people act too readily on limited information, but they also are too willing to act when they are wrong. It has been said that, ‘it is not what a person doesn't know that makes them look foolish, but what they think they know but which is in fact incorrect’.

The Barber and Odean study demonstrated that overconfidence leads to more trading and to lower investment returns. They found that the average trading turnover rate for men at 77 per cent was approximately one and half times that for women at 53 per cent.

This was supported by Gallup Polls conducted between 1998 and 2000 which asked, ‘What overall rate of return do you expect to get on your portfolio in the next twelve months?’ and ‘Thinking about the stockmarket generally, what overall rate of return do you think the stockmarket will provide investors during the coming twelve months?’

On average both men and women expected their own portfolios to outperform the market – in the same way that every one considers themselves to be a better than average driver. However, the men expected to outperform the stockmarket by a greater margin of 2.8 per cent compared to the women who forecast beating the market by 2.1 per cent.

In the Barber and Odean analysis 62.5 per cent of men rated themselves as having good or extensive investment experience as against only 47.8 per cent of women. The study determined a ‘relevant benchmark’ to calculate the extra return (if any) gained by each investor from increased trading activity. Put simply, it compared the actual return with the return that would have been earned if investors had merely held their initial portfolio for the entire year.

They found that the shares which investors elected to sell consistently outperformed the shares that they bought leading to under performance in all cases. However, because men had a higher turnover of shares throughout the period of study, on average the trading activity of men detracted from benchmark performance by more than women, losing 2.65 per cent per annum compared with 1.72 per cent per annum.

Single men fared worst of all. They were most overconfident (with 63.7 per cent rating themselves as having either good or extensive investment experience), traded more excessively (at 60 per cent more than women and 15 per cent more than married men) and suffered the greatest drag on performance, (losing 2.9 per cent per annum).

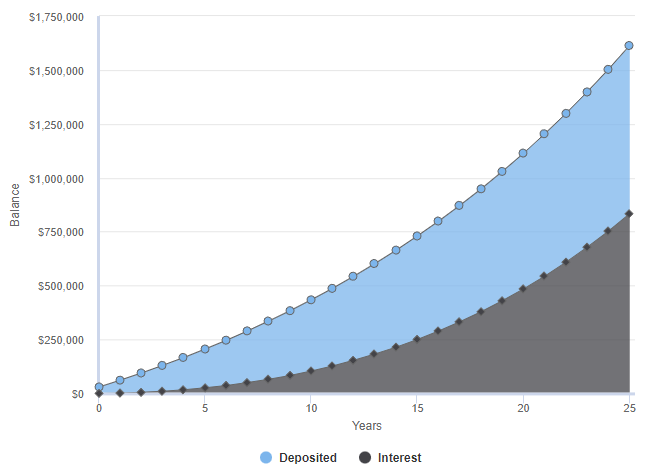

These differences may not sound like much, but in fact they are gigantean. A simple compound interest calculator is a useful tool here. Let’s assume that you have the savings capacity of about $30,000 per year. In a vanilla portfolio holding 60% growth assets you can expect an average return of about 8% per year. In the event you behaved like the typical male investor you would have saved a total of $1,613,282 over 25 years. The interest component of this would be $833,282. Not too shabby - one would think.

However, if you were able to keep your ego at bay and refrain from tampering with your portfolio you would have achieved a total savings of $2,398,632 over the same timeframe. The interest component of which would equate to $1,618,632 –double what you would earn if you had tried to time the market.

The empirical research provides compelling evidence of the impact of investor psychology on investment success. We should all beware the enemy within.